Why You Should Think About Making Your Next Investment in Africa

Africa as a continent is thriving. The second-largest continent on Earth offers a range of investment opportunities and is regularly commended for having one of the world’s fastest growth rates. The country has attracted investors from all over the world due to the dramatic increase in middle-class households and the large areas of undeveloped agricultural land. Microsoft, Google, Heineken, and Coca-Cola are just a few examples of international businesses that have established themselves and had (very) great ROI.

4 Opportunities in Africa

Transportation

A report from the African Development Bank claims that since 1950, the percentage of people living in cities has increased from 14 to 40%. It is projected that this number would increase to 50% by the middle of 2030. The shift toward metropolitan areas has raised the demand for transportation services, and there is growing resentment about the lack of availability.

African entrepreneurs earn regular incomes nowadays, particularly in the transportation sector. Quick-thinking investors have amassed a committed audience by making vehicles available to urban commuters through the introduction of Uber to the African continent.

Retail

The retail sector on the African continent keeps growing swiftly year after year and doesn’t appear to be slowing down. The rapid pace of urbanization and the advent of payment methods, such “M- PESA’s” partnership with “Paypal,” have both greatly accelerated the growth of this sector. Depending on the consumers’ purchasing power and rate of growth, the discrepancies among them may fluctuate. Choosing the right offer and target market is so essential.

Agriculture

According to the World Bank, Africa’s agribusiness is anticipated to be worth $1 trillion by 2030. 60% of the world’s uncultivated land lies in Africa, and agro-processing is predicted to overtake mining and metals in the not-too-distant future. Africa’s agriculture industry has undergone a technological revolution that has enabled a small number of companies to produce on a large scale while spending less.

Investors frequently consider Uganda’s agricultural potential to be the best on the continent. Due to Uganda’s two rainy seasons and almost constant temperature, the country experiences abundant crop harvests every year.

Coffee, tea, sugar, livestock, edible oils, cotton, tobacco, plantains, corn, beans, cassava, sweet potatoes, millet, sorghum, and groundnuts are some of the most often purchased products.

Energy Solutions and Power

Africa is now being used as a global test bed for more environmentally friendly energy alternatives. Numerous companies and investors have started testing green energy solutions extensively over the continent. Nigeria is the first country in Sub-Saharan Africa to establish a facility of this kind, having even opened an academy to train specialists in the field of renewable energy. This exemplifies how renewable energy firms already see Africa as a promising area.

The African power sector offers the potential for very significant long-term returns on investment. Solar and hydropower are just two of the sustainable energy sources available on the continent.

Investors are swarming to this gold mine because the African continent currently has a considerably larger demand for electricity than it does supply. In up to 80% of African households, firewood and charcoal still serve as the primary energy sources. In Sub-Saharan Africa, barely one in three people have access to electricity.

These are only a few commercial prospects to take into account; given how rapidly Africa is developing, there are hundreds more to be on the lookout for. These opportunities will benefit both the investment firms and Africa as a whole.

Angola

Angola Benin

Benin Burkina Faso

Burkina Faso Burundi

Burundi Cameroon

Cameroon Central African R.

Central African R. Chad

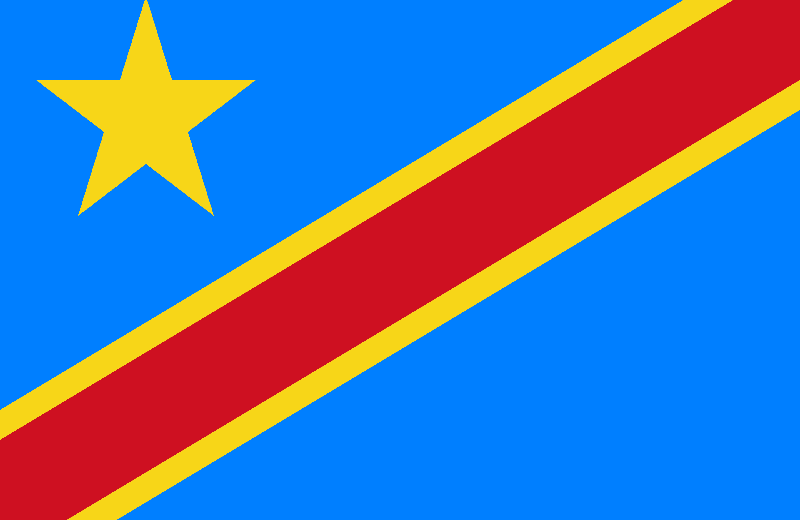

Chad D. Republic of the Congo

D. Republic of the Congo Djibouti ECTN

Djibouti ECTN Egypt

Egypt Equatorial Guinea

Equatorial Guinea Gambia

Gambia Gabon

Gabon Ghana

Ghana Guinea Bissau

Guinea Bissau Guinea Conakry

Guinea Conakry Ivory Coast

Ivory Coast Republic of Congo

Republic of Congo Liberia

Liberia Libya

Libya Madagascar

Madagascar Mali

Mali Niger

Niger Nigeria

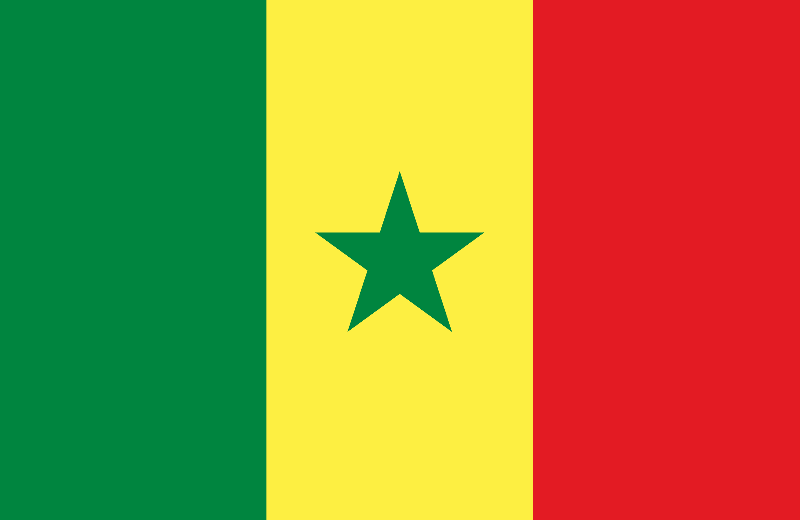

Nigeria Senegal

Senegal Sierra Leone

Sierra Leone Somalia

Somalia South Sudan

South Sudan Togo

Togo